tax loss harvesting canada

Tax loss harvesting is an additional method of tax management in regards to investment planning. At first glance the superficial loss rule appears to limit the options for investors.

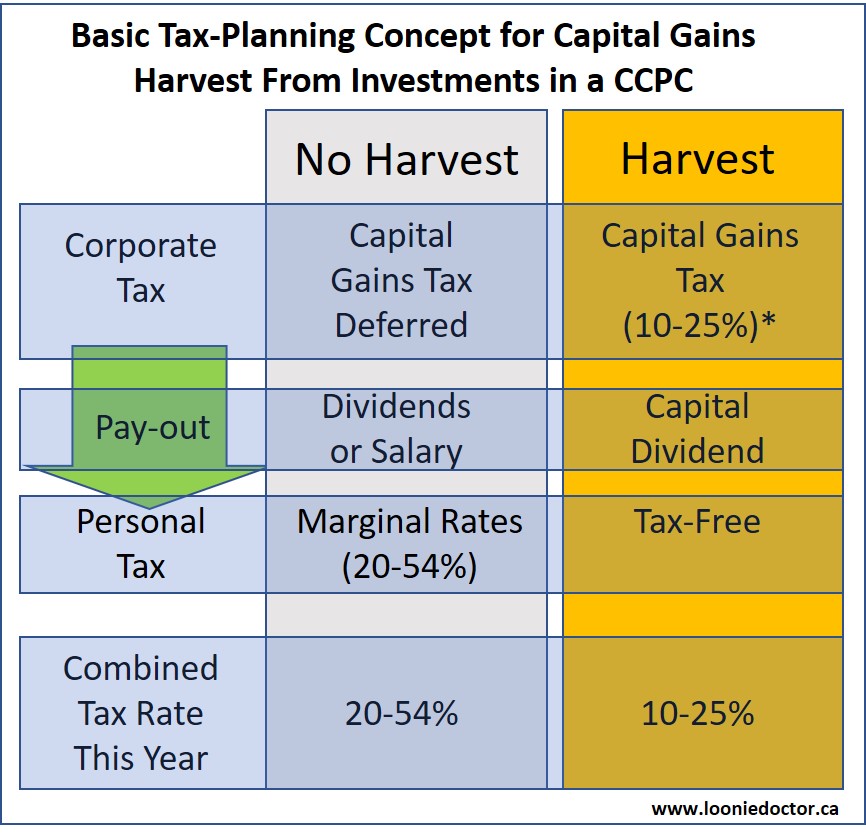

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

The 3 best robo advisors for tax-loss harvesting.

. So if you lose 1000 on investment you could save around 300 on your taxes. Rebalancing helps realign your. Essentially when you sell a stock at a loss you cannot buy the stock 30 calendar days before or after the stock.

Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. Tax loss harvesting also known as tax loss selling is the practice of selling shares or units held in a non-registered account that have dropped in value to the point that a capital loss can be claimed eg. The Canada Revenue Agency provides the following examples of affiliates.

Canada Revenue Agency CRA rules specify that you or an affiliated person cannot buy back the security again within thirty. Tax-loss harvesting is a pretty neat investing trick to save money on your tax bill. Tax-loss harvesting involves selling an.

TFSA Tax Free Savings Accounts Basics. You can then use these losses to offset your taxable capital gains. When you start investing you dont set.

It lets you book a capital loss while. One of the best scenarios for tax-loss harvesting is if you can do it in the context of rebalancing your portfolio. This rule states that if an investor buys back the same security within 30 days of sale the tax benefit from the capital loss will be nullified.

If you sold at a loss on or. Government of Canada as of January 2021 3 Bloomberg and Mackenzie Investments as of November 23 2021. In Canada the last day in 2021 for tax-loss selling on the Toronto Stock Exchange was December 29 2021.

One consideration for investors when employing tax-loss harvesting is the superficial loss rule. Best GIC Rates in Canada for 2020. Jan 12 2018 Tax Loss Harvesting.

These investments could be stocks bonds mutual funds andor exchange-traded funds ETFs. Tax-loss harvesting is a tax strategy where you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere. Air Canada TSXAC Bank Of Nova Scotia TSXBNS.

Theres something called the superficial loss rule in Canada that says that you cant buy the exact same investment within 30 days of selling it and still take advantage of the loss on your. How Much Can You Save with Tax-Loss Harvesting. In fact a sound tax-loss harvesting strategy can result in significant tax savings over the years.

As an example suppose you invest 100000 in a Canadian equity ETF and then the value declines to 90000. This article talks about the benefits of tax loss harvesting and how you can incorporate it in your investment portfolio. Tax-loss harvesting is a tax strategy where you intentionally sell an investment for a loss in order to offset capital gains taxes elsewhere.

But its not for everyone. 0 for Betterment Digital and 100000 for Betterment Premium. Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered accounts.

How many years can a loss be. Mutual funds and ETFs sponsored by Fidelity Investments Canada ULC are only. These investments can be sold.

Here youll be able to see all your tax-loss harvesting opportunities. Tax-loss harvesting is a practice that takes advantage of the rules that let you use capital losses to offset other forms of taxable income. At its most basic tax-loss harvesting involves intentionally selling poorly performing investments for a loss and reinvesting the proceeds back into the market.

Heres how it all works. Getting started with tax-loss harvesting. Basically if you have made an investment in general it is unwise to sell that investment at a loss.

Apparently tax-loss selling to minimize capital gains in Canada you should also be aware of the superficial loss rule. Navigate to the tax-loss harvesting tab. Hi there two questions about tax harvesting.

Given that tax-loss harvesting involves selling and. Jan 15 2021 Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada. A method of crystallizing capital losses by selling losing positions and purchasing companies within similar industries that have similar fundamentals.

Of course I am not a tax specialist. Tax-Loss Selling Made Crystal Clear. However in general you can expect to save around 30 of the amount of the loss.

Generate your tax report. Once youve recorded all of your transactions youll be able to generate a tax report with the click of a button. Capital gains will need to be paid after an investor sells any stock for a profit.

By deferring thousands of dollars in. For the average Canadian investor the term tax-loss harvesting might sound complicated but its pretty straightforward providing that you follow a few rules. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket.

The process of tax-loss harvesting can be complicated so before engaging in this strategy I recommend speaking with your in-house tax specialist to ensure you are doing it right and within the Canada Revenue Agencys guidelines. Avoid superficial losses. If you sold at a loss on or before that date you could deduct.

By selling your shares you can crystallize a capital loss of 10000 and potentially use that loss to offset a 10000 capital gain elsewhere in your portfolio. Stocks purchased or sold after this date will be settled in 2021 so. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada.

Tax Loss Harvesting Canada. In Canada 50 of capital gains are taxable. Tax-loss selling also known as tax-loss harvesting is a strategy used to reduce taxes on capital gains incurred from the sale of an asset.

However capital losses can be applied against capital gains to reduce the gain amount in order to lower the taxes owed. What is tax loss harvesting and how you can protect your future gains from taxes through your losses. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in CanadaYou can then use these losses to offset your taxable capital gains.

You have until two trading days before the end of the year to sell assets to qualify for tax-loss harvesting however it is recommended that investors do this quarterly.

Investment Workshop 57 Tax Loss Harvesting Millennial Revolution

Turning Losses Into Tax Advantages

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

What Is Tax Loss Harvesting Ticker Tape

Koinly Blog Kryptowahrung Steuern News Strategien Tipps

What Is Tax Loss Harvesting Ticker Tape

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

When Does Tax Loss Selling End In Canada Ictsd Org

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

I Get Free Tax Loss Harvesting Awesome Wait What Is That Wealthsimple

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Turning Losses Into Tax Advantages

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

How To Use Tax Loss Harvesting To Boost Your Portfolio

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting At Work A Wealthsimple Case Study Boomer Echo